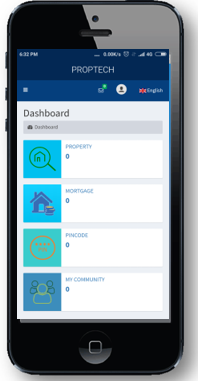

The rise of Property Technology, often referred to as PropTech across the globe represents the combined result of the real-estate, Internet-of-Things (IoT), finance and technological industries. This integration has led to many technopreneurs partnering with traditional real-estate players to refine and improve business processes to reduce expenses.

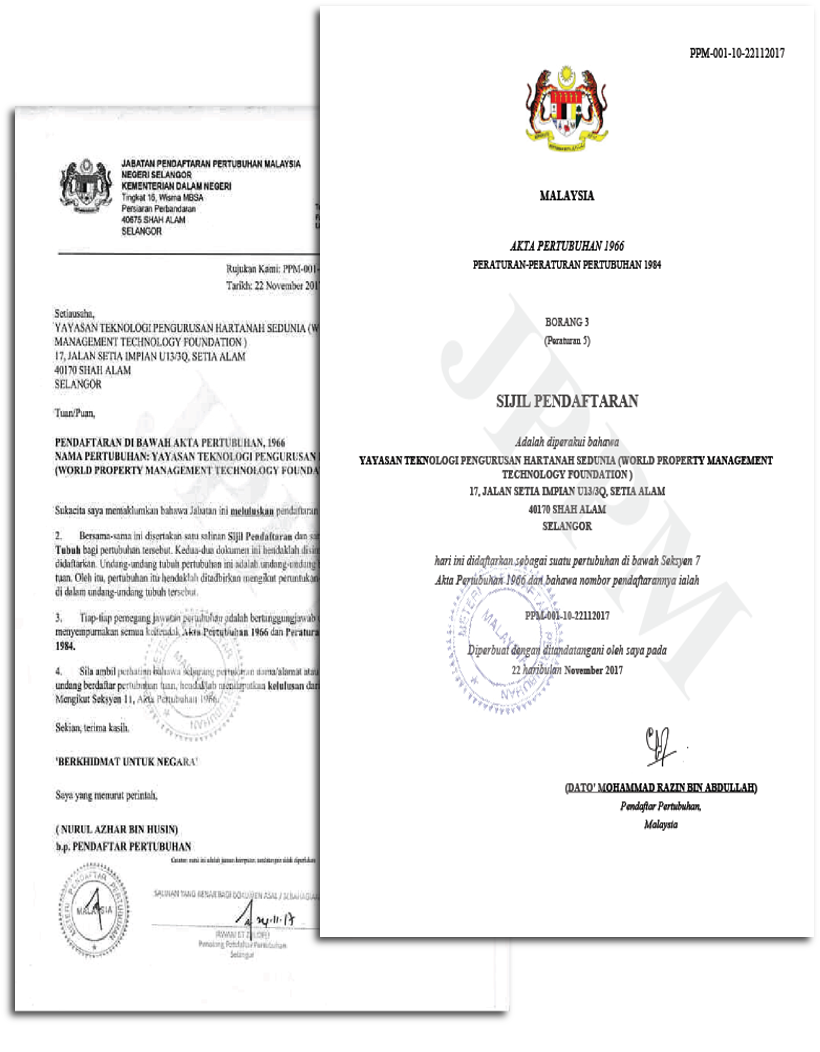

It is the ambition of the World Property Management Technology Foundation to promote better professional collaboration across these industries, aiming to provide more valuable properties and complementary products and services to the consumers, to maximise consumer benefits.

To establish a mortgage loan advisory team to enable mortgage loan consumers to obtain proper advice and assistance, helping them mitigate potential mortgage loan crises, improve loan repayment ability, and make savvy financial investments.

To establish the real-estate investment management advisory team and prevent unnecessary losses caused by predatory loan practices, collateral damages and speculation by providing relevant current practices, investment management strategies and market trends to double the return on investment (ROI).

To create a brand new large-scale low-risk market for financial institutions and personal investments in the real-estate industry.

To produce a win-win situation to meet the needs of the underprivileged group and property owners, ensuring affordable and financially secured housing properties.

To capitalise on communication technologies in providing financial and real-estate information and facilities to improve quality of life.